Hello! I hope you are doing well. I would love to share with you some ways to invest in real estate and provide you with the necessary tools and knowledge to make your next investment with confidence and security, achieving the results you desire. Allow me to be your guide on this exciting investment journey and help you reach your financial goals!

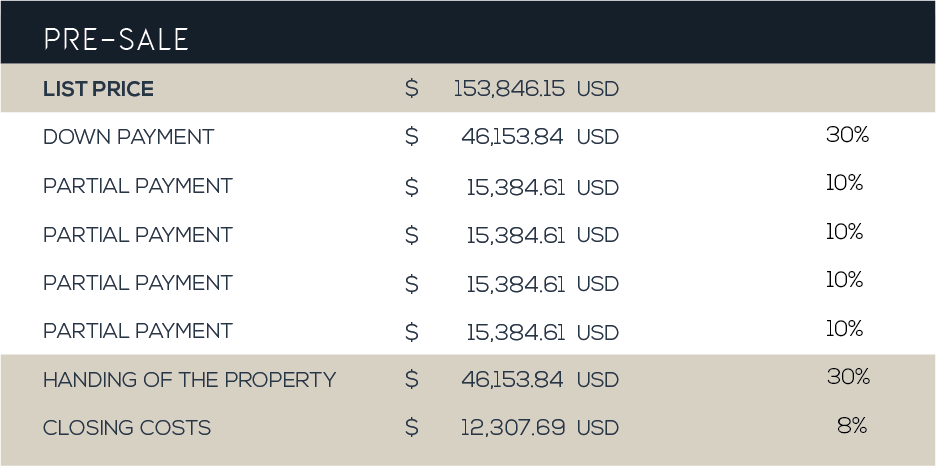

PRE-SALE:

Buying in pre-sale has become very popular as it allows you to acquire a property and pay for it while it is being built. This gives you 1 to 2 years to pay for the property without interest. It is important to mention that we will only recommend solid developers with proven experience in the area to ensure the timely execution and delivery of the project. The usual payment method is 30% of the value of the property as a down payment and 40% in payments during the progress of the work, leaving a balance of 30% of the property upon delivery.

SMART TIP:

The best pre-sale opportunities are those developments that offer to pay 30% as a down payment and 70% upon delivery. This way, you can finance the 70% with a mortgage loan 1 or 2 years later when the building is ready for delivery. This way, you won’t deplete your capital.

EXAMPLE:

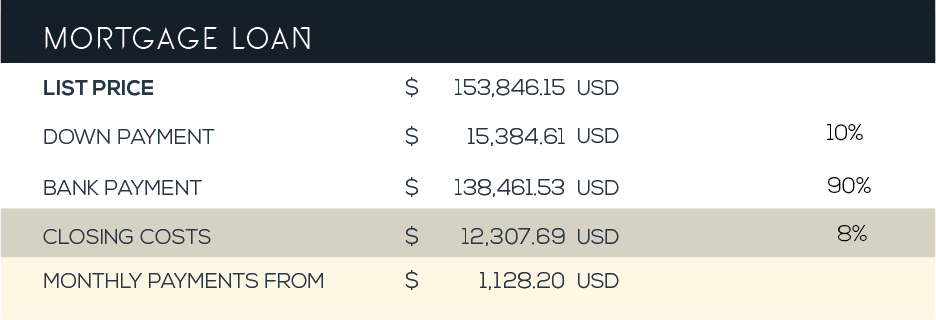

MORTGAGE LOAN:

In Mexico, mortgage loans have an interest rate of 10% to 12% and can finance the purchase of your property for 10 to 20 years. It is a comfortable way to acquire a property, especially if you are thinking of an investment property to rent in the long term or as a vacation property. With the same profitability, you can pay your loan month by month and self-finance your purchase.

To acquire a property with a mortgage loan, it is necessary that the property is finished and ready to be notarized, making your purchase immediate. The costs to consider are 10% to 30% as a down payment, depending on the capacity that the bank approves according to your credit profile, plus your closing costs in the notary, which range from 5% to 7%.

The mortgage loan is always the way you will have the lowest initial outlay. But it is important that you can make advance payments to your loan to avoid paying too much interest. On average, most of the population finishes paying off their loan between 5 and 6 years.

EXAMPLE:

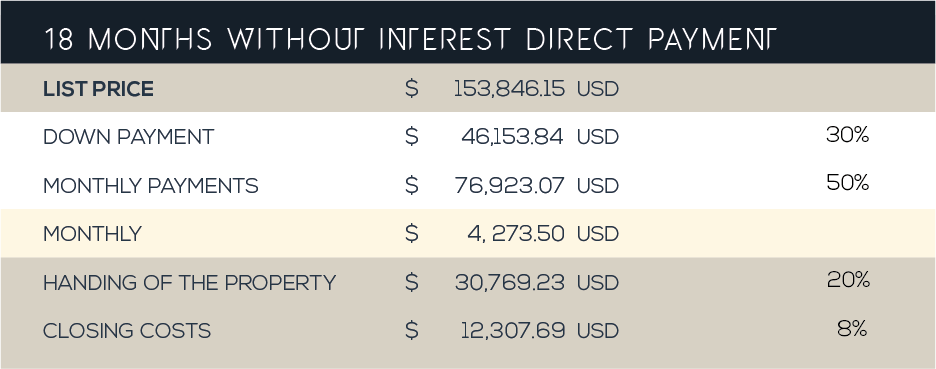

DIRECT FINANCING:

Some developers offer direct financing from 1 to 4 years, with and without interest rates. Although opportunities in this area are few, it is worth looking at them, as you can usually use the unit while you are paying your installments.

CASH PAYMENT:

By paying cash for a property, you have the great advantage of being able to negotiate the price because you can pay a high down payment. You can get discounts ranging from 3% to 10% depending on the stage of development, and you will have greater advantage in pre-sales, but we can also negotiate on properties with immediate delivery.

SMART TIP:

We always recommend leaving a balance of 10% or 20% at the signing of the deed. This will generate an incentive for the developer to expedite their legal area to transfer the property to your name instead of postponing it. Never pay 100% if you do not have your deed in hand.

IMPORTANT NOTE:

The closing costs include 3% taxes, 1% acquisition, rights, notarial costs, and your title deed (Escritura). It is important to clarify that these costs vary according to the property, appraisal, and customer profile. For Mexicans, the closing costs range from 5% to 7%, and for a foreigner, it ranges from 6% to 8% on the cost of the property, as they will also have to add the cost of a Trust.

NOW THAT YOU KNOW THIS, WHAT IS THE IDEAL WAY FOR YOU TO INVEST?

All rights reserved Astrid Fierro

Contact us if you looking for a safe investment

Email: sales@lotusrivieramaya.com

Call us: +52 984 276 2391