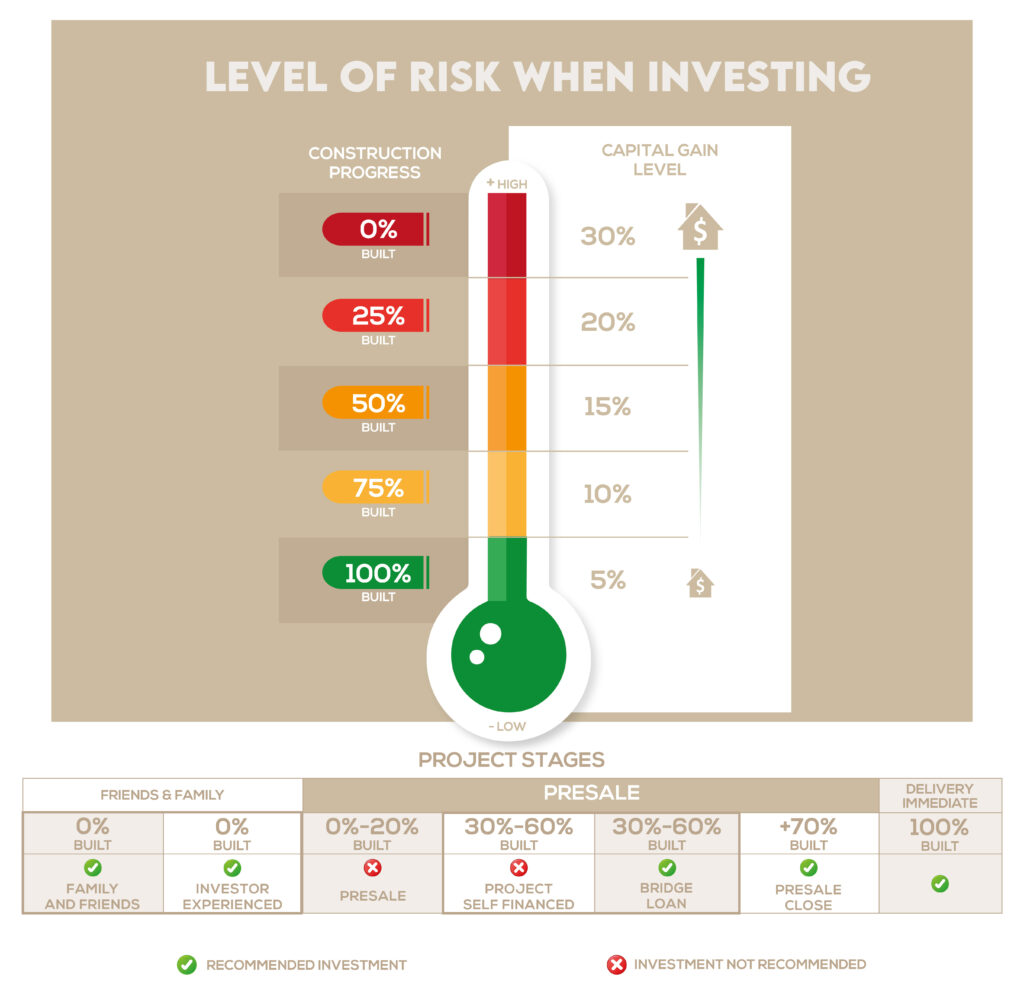

In today’s blog, we are taking a closer look at the lifecycle of a pre-sale, and what each phase involves.

If you have been eager to add a pre-sale property to your investment portfolio but you are unsure how to proceed, the best place to start is understanding how such a development is taken through each stage up to completion and handover to owners.

PHASES OF PRESALE UP TO IMMEDIATE DELIVERY

0% Friends & Family:

You invest in the developer’s dream; they do not yet have construction permits, they are your friends and/or family, and you trust them. It is important to know that delivery delays are usually much longer at this stage.

0% Experienced Investors:

You invest in the development in the Friends & Family stage. There are no construction licenses yet, you do not know the developer, but you trust your instinct, you have invested in pre-sale before, and you know how long-term investments work. So you have no problem waiting for the delivery for 2 or 3 years, knowing that there may be delays due to the early participation of your investment in the project. You know the market and you know the capital gain you can earn by investing in the Friends & Family stage.

20% Presale:

The project already has its construction licenses and all the legal documentation to start its work, progress of work is from 0% to 20%.

30% Self-financed Presale:

Construction progress 30%-60% Some developers decide NOT to acquire a bridge loan; if it is the case, observe the unit sales rate since these developers are financed from the pre-sale, their own resources, and private investors. These cases are the ones that usually have the greatest delays because the flow of capital investment to work is variable and depends on several people. This type of pre-sales is usually delayed depending on the displacement of the units or effective sales.

30% Presale with Bridge Loan:

Upon reaching 30% completion of work, developers can apply for a bridge loan. A bridging loan is an excellent guarantee for the investor; if you buy pre-sale, the development you choose is best to have this financial support. A bridge loan guarantees finishing the work without pauses or lack of capital for construction.

If the development you have chosen does not have a bridge loan, check the developer’s experience, the volume of sales, and the frequency of absorption of its units.

80% Presale with deeds:

We can say that a pre-sale is safe when its work progress is significant; it could have between 70% and 80% work progress, in addition to a volume of sales between 60% -100%, your condominium regime is ready or in process with delivery in the next 6 months to your purchase.

100% Risk-Free Investment:

When the building is 100% completed and has the Condominium Regime, you can acquire your property in cash, receive your deeds, and access a mortgage loan.

All rights reserved Astrid Fierro

Contact us if you a looking for a safe investment

Email: sales@lotusrivieramaya.com

Call us: +52 984 276 2391